KraneShares launches active ETF of ETFs

KraneShares, the New York China ETF specialist, is launching an actively managed umbrella fund that invests mostly in its own ETFs.

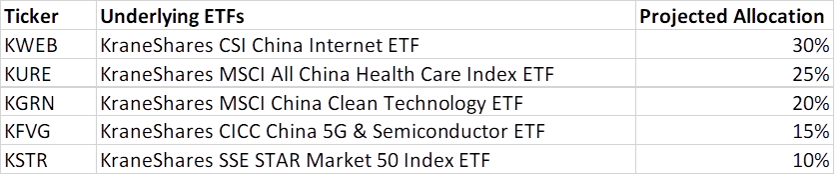

The KraneShares China Innovation ETF (KGRO) will invest 85% of its assets in KraneShares other China ETFs. The ETFs chosen will target China’s new economy, which refers to the higher growth areas like tech and healthcare that don’t have any state-owned enterprises. The specific ETFs and their projected allocations are below.

The remaining 15% of KGRO’s assets will be invested in privately owned Chinese businesses that may have their IPOs soon. This is the first ETF to my knowledge that buys privately owned Chinese companies.

While the fund is actively managed, it is fully transparent.

KGRO charges 0.99%.

Analysis – interesting but expensive

There’s a lot to like here. For one, China is a great investment destination and the governments’ ongoing clampdown on tech companies has made the country’s stock market look decidedly cheap. For two, you get to partner with a Chinese state-owned bank (ICBC) and invest in privately owned companies.

If I had a question about this fund it is the fee. A full-blow 1% is high for an ETF. Potentially too high in my opinion considering this is an umbrella ETF. And in case anyone is wondering: the 1% includes the underlying ETF fees. There is no double dipping.

There may be mitigating circumstances that help justify the fee. For one, China is more expensive. The trading infrastructure and licensing cost money to build out. And the supply chain costs like brokerage, custody and fund admin are higher in mainland China. However they’re not *that* much higher such to explain this fee. And certainly not that much higher for ICBC, the majority shareholder of KraneShares.

Another mitigating point may be the buying into private companies. This is more expensive and requires a lot more work (and another set of competencies) than simply trading public stocks.

I wonder what the market will think.

.png)