Psychedelics ETF

AdvisorShares, an ETF provider known for its edgy thematic ETFs, has just launched a psychedelic drugs ETF. The AdvisorShares Psychedelics ETF (PSIL) will buy global businesses that make a significant proportion of their revenue from psychedelics.

The active strategy will target companies based on market share, revenue purity and other things. It is unclear what the logic is for choosing active management as indexes are available.

Psychedelic drugs are sometimes prescribed by psychologists and psychiatrists in some countries. As I understand, the therapies are experimental but som evidence suggests they can be used for treating alcohol addiction and severe depression. However they remain illegal in many countries.

This is not the first psychedelics ETF. In Canada, Mirae-owned Horizons ETF has C$60M in its psychedelics ETF (PSYK), which it listed earlier this year. In the US, Defiance launched a psychedelics ETF (PSY) a few months back. It holds just $9M in assets.

AdvisorShares marijuana ETFs have proved very successful and collectively hold over $1 billion. Their success likely led AdvisorShares to think it could be replicated with other drugs.

The fund charges 0.68%, which makes it a slight under-pricing of Defiance’s PSY which charges 0.75%.

Bernie’s commentary – mind-blowing performance

There’s a lot of interesting things to say about a psychedelics ETF.

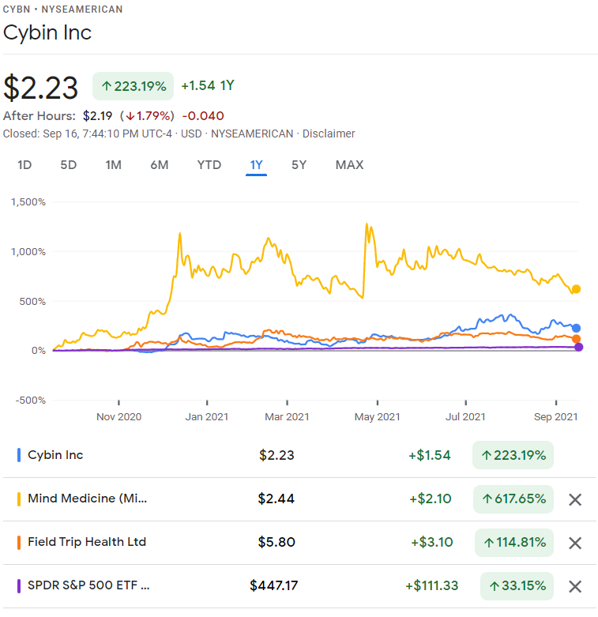

- Pure-plays make the performance mind-blowing. There are relatively few pure-play psychedelics companies. They include: Cybin, Field Trip Health, Atai Life Sciences and Mind Medicine. If you’ve got free time today, go look at their share prices. Cybin’s fell -85% in two weeks, and then rose 1,500% in the following months. Mind Medicine is up 600% the past twelve months.

- Big pharma could be added for ballast, but won’t be. With the volatility of these pure-plays it can help to add big pharmaceutical companies for ballast. Many thematic ETFs do something like this to smooth performance. While diversified multinationals often flunk thematic revenue purity tests, they are still important parts of the industry (think Amazon and cloud computing). The Defiance ETF (PSY) holds just 14 companies, all pure plays. PSIL’s investment strategy suggests it may do something similar.

- Surely there are capacity constraints. The market cap of some of these psychedelics companies is tiny. Some have as little as $350M in market cap. This means that if these psychedelics ETFs see lots of inflows, they could end up becoming among the biggest shareholders of these companies, raising governance questions. Furthermore, with companies this small, ETF inflows could even set the stock prices.I’m guessing this may count as an argument in favour of active management for this niche.

Still, there’s a lot to like here. I think it’s a potential growth area and may be a good satellite exposure. These thematic ETFs are exposing some very interesting niches that cannot be addressed by standard index classification, and this can allow people to be very targeted in their strategy.

.png)