EV charging infrastructure

European white-labeller HANetf has launched another global warming related ETF. This time targetting charging stations for electric cars.

The Electric Vehicle Charging Infrastructure UCITS ETF will track the Solactive Electric Vehicle Charging Infrastructure Index, which was purpose built for this fund and bears its name.

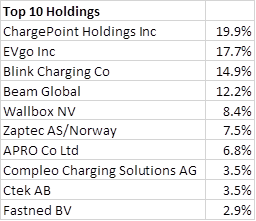

The index targets global companies that make battery charging equipment and EV charging stations. Solactive uses FactSet’s RBICS industry classification system to judge whether companies fit the mould. It then uses an ESG screen to remove violators of the UN Global Compact. The top 10 holdings are below.

The fund charges 0.65%.

Bernie’s commentary – I like the idea

The electric cars theme has been cut and sliced every way. We have electric car ETFs, which buy car makers like Tesla and BYD. We have battery metals ETFs, which buy the commodities like nickel and copper. We have battery ETFs, we target companies making batteries like Panasonic. And on and on.

But this is a new approach, and an interesting one. And in my view it will work, as it ticks the three boxes that any aspiring thematic ETF needs to tick. What are the three boxes?

First box: there must be pureplays. Investors buying a theme don’t want to be sold the FANGs in a different package. (i.e. Canadian metaverse ETFs, which are just a rebranding of the FANGs). While relatively few in number, pure-play EV charging stations and equipment makers do exist. A lot of them have come to life very recently, thanks to SPACs. (As an aside, I think that’s where the next generation of thematic ETFs is going to draw its pureplays from: SPACs.) First box ticked.

Second box: the theme must be real and not a fad. (Remember work from home ETFs, launched two years ago? That was a fad.) Self-evidently, EVs are here to stay and not a fad. They are replacing ICE cars, with government support. And EVs need charging stations—much like ICE cars need petrol stations. So second box ticked.

Third box: the theme cannot be fully priced. You can have the best thematic in the world, but if it is priced to perfection there’s no point. The share prices of these EV charging companies have been crushed this year, thanks to coal baron Joe Manchin killing Build Back Better, which contained huge subsidies for EV infrastructure. With interest rates rising, loss-making companies like the guys in this index are getting discounted more heavily. And what is more, the market always applied a discount to companies that derived from SPACs anyway. So that’s the third box ticked too.